Published: 19 January 2022

In general, investors tended to pay more attention to strong US economic statistics than to weak numbers. As it happened, there were not too many weak data points that they had to overlook. The “National Bureau of Economic Research Business Cycle Dating Committee” (yes, there is such a body) exists to pass judgments on booms and recessions and, in its opinion, the recession was over almost before it had begun.

The employment data were mostly supportive, with monthly job growth averaging 586k in the first eight months of the year. At one point, the 8.7 million people counted as unemployed were outnumbered by the 10 million job vacancies on offer.

Consumer confidence surveys delivered a variety of results. The University of Michigan said that only six times in 50 years had there been larger monthly declines. At the same time, those supposedly downhearted consumers were happily piling into the residential property market, taking the S&P house price index 19.9% higher in the year to July. In Phoenix, Arizona, house prices were up by almost a third.

Internationally, the most visible political action in the States was the military withdrawal from Afghanistan. Domestically, and as far as financial markets were concerned, it was not a significant event.

What they did care about was the economic stimulus package fighting its way through Congress. The president is in the unenviable position of facing opposition from both sides. Opposition Republicans don’t like it because it is too wide-ranging; some of his own Democrats object that it does not go far enough.

Part of the fall-out is the battle to increase the debt ceiling. Legislators in America vote separately on deciding to spend money and financing that expenditure. Just about every autumn Congress refuses to increase the mandated limit to government borrowing, making national park workers and other temporarily unemployed. It is happening again at the moment.

For many months the Federal Reserve has maintained that high inflation is “transitory”. As the headline rate has climbed to 5.3%, that position has begun to look questionable. While the economic rebound from Covid shutdowns undoubtedly is a short-term influence, supply chain disruptions and high energy prices could be longer-lived. Investors, and certain members of the Federal Open Market Committee, are asking themselves whether the Fed should recognise this and tighten monetary policy.

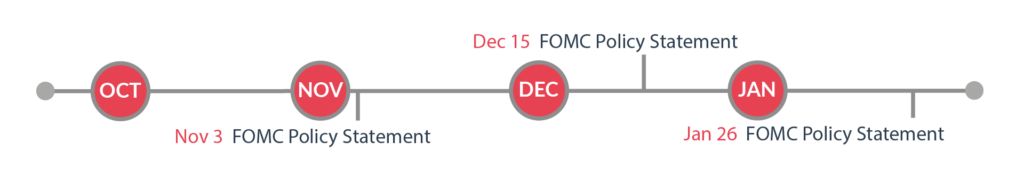

The latest suggestion from Fed Chairman Jerome Powell is that the bank could begin to phase out – “taper” – its asset purchase programme before the end of the year. Looking from a different angle, the supporting documentation from September’s FOMC meeting showed half of the committee’s members are expecting interest rates to move higher next year.

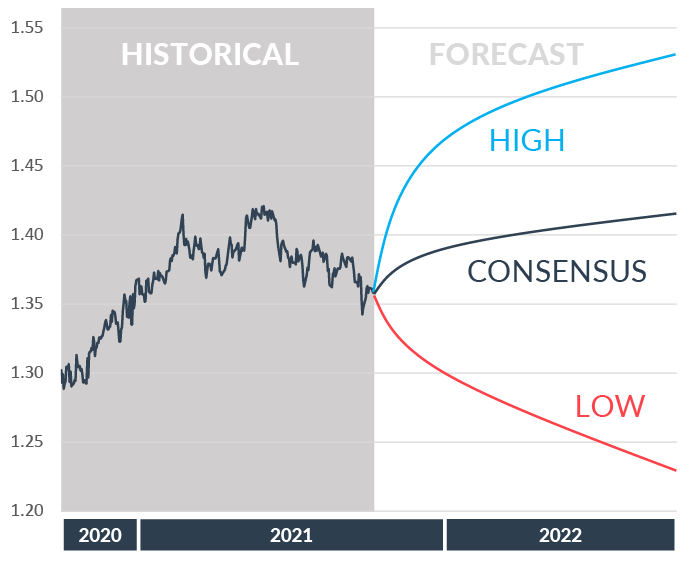

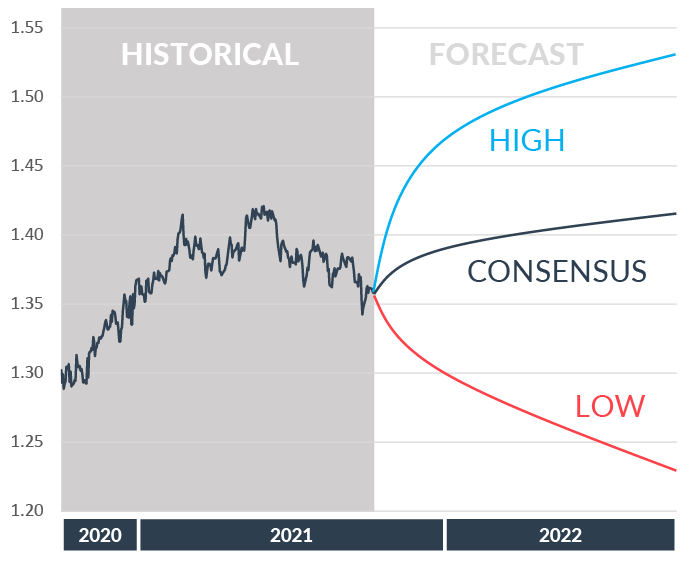

The US economy has generally had the strongest recovery of the major economies. Employment and spending data suggest the Federal Reserve will start tapering their asset purchases this quarter with rate hikes starting in 2022. As a result of the increasing rate expectations and concerns over further supply disruptions, the dollar has benefitted generally, pushing back from 1.42 to 1.35. Generally forecasts are for a reversal of this move, but there is a high degree of uncertainty.

The US economy has generally had the strongest recovery of the major economies. Employment and spending data suggest the Federal Reserve will start tapering their asset purchases this quarter with rate hikes starting in 2022. As a result of the increasing rate expectations and concerns over further supply disruptions, the dollar has benefitted generally, pushing back from 1.42 to 1.35. Generally forecasts are for a reversal of this move, but there is a high degree of uncertainty.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

The UK continues to be affected by supply disruptions. Whilst the economy has continued to rebound almost to pre-pandemic levels, significant risks remain. The BoE are likely to raise rates sooner which could support sterling.

The European Union has also been hit by supply constraints and rising inflation, though the European Central Bank seems most keen to look through these issues. As the slowest to move, the euro may remain on the back foot.

The Australian Dollar has had a tough time, with lockdowns in Australia and reduced orders from China. Going forward, Australia seems to be coming through the worst of the disruption and the Australian Dollar could make back some ground.

Although New Zealand has been the least affected by lockdowns and disruption, they are now following the path of others through vaccination. The central bank is keen to normalise rates and this could further support the Kiwi.

Despite an increase in the oil and commodity prices, the loonie has not seen much benefit. The supply disruptions have outweighed oil prices and inflation remains a concern, though the central bank does not look likely to act immediately.