Published: 19 January 2022

The labour shortages in road haulage, social care, hospitality, farming and food production have not yet had any serious, measurably damaging effect on the economy. But it is hard to imagine that such a situation will continue. A couple of hundred tanker drivers from the Army and the offer of three-month visas to European truckers are unlikely to rectify the problem, which is both reducing turnover (and therefore tax receipts) and stoking inflation (one petrol station was reported to have sold out swiftly despite charging almost £3 a litre).

Two other dogs that have so far refused to bark are the Covid “freedom day” in early July, and the government’s war of words with the EU regarding the Northern Ireland Brexit protocol. Freedom day was supposed to push up the rate of inflation but failed to do so because the habits of small gatherings and social distancing were not easily ditched. With the Northern Ireland protocol, although it is still on the to-do list of Brexit minister David Frost, the triggering of Article 16 would not solve the problem but merely set in motion another round of negotiation.

Recent UK economic data have tended to support the idea of an economy rebounding from its Covid shutdown(s). Gross domestic product expanded by 5.5% in Q2 and by 23.6% in the year to end-June. Inflation jumped to 3.2% in August. Average earnings were up by an annual 8.3% in July. But Covid distortions abound. In the case of earnings, lower-paid people unable to work from home were those mostly laid off, leaving a higher average income. If all the short people leave a room, the average height of those remaining will go up, but not because they have become taller.

Without the luxury of a 76-seat majority in the House of Commons, Boris Johnson’s government would undoubtedly have found the last few months rather more difficult to navigate. As things are, the prime minister can do whatever he wants, whenever he wants to do it, without fear of being defeated in the House. Although they might, individually, see some of his measures as inappropriate, investors are more comfortable with a “strong” government than an endangered one.

There is considerable hand-wringing in Britain about the chancellor’s imminent double-whammy of higher national insurance contributions and reduced universal credit payments. In all likelihood, it will have little or no direct impact on the UK economy, given that only the poorest people will be hurt, and they are not significant contributors to consumer spending. In the longer run, though, the measures might erode support for Johnson’s government.

Johnson’s next big decision is whether or not to begin Article 16 proceedings. His previous actions suggest he would not be embarrassed to torpedo the “oven-ready” Brexit deal which he and Frost themselves demanded from the EU and signed less than a year ago. A move in that direction would not necessarily be good for the pound.

Most recently, at 3.2% for August, UK inflation is at a nine-year high. The Bank of England’s bank rate has been at an all-time low of 0.1% since March last year, and the two numbers do not, from a traditional economic standpoint, sit comfortably together. The Old Lady argues that the rebound of prices from a Covid-induced slump cannot be fixed by higher interest rates, especially if they temper the economic recovery.

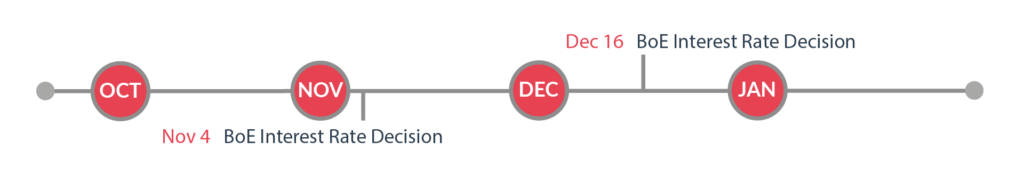

That having been said, two members of the Monetary Policy Committee did vote for a rate increase in September, in anticipation that inflation will exceed 4% before the end of the year. Whilst there is no suggestion that the two will quickly be able to recruit the necessary three allies for a 5-4 majority, it does show that the MPC is beginning to think such thoughts.

The last quarter has seen sterling move in a tight range against the euro, lacking any major directional moves. We have bounced from just above 1.15 to 1.18 and back again. With the MPC more likely to increase rates than the ECB and the UK economy continuing to recover, there are more reasons for sterling strength. The central view is a stronger pound, but a wide range of forecasts reflect the significant uncertainty.

The last quarter has seen sterling move in a tight range against the euro, lacking any major directional moves. We have bounced from just above 1.15 to 1.18 and back again. With the MPC more likely to increase rates than the ECB and the UK economy continuing to recover, there are more reasons for sterling strength. The central view is a stronger pound, but a wide range of forecasts reflect the significant uncertainty.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

The European Union has also been hit by supply constraints and rising inflation, though the European Central Bank seems most keen to look through these issues. As the slowest to move, the euro may remain on the back foot.

Rising inflation and rebounding employment and economy are pushing the Federal Reserve to reducing asset purchases this quarter. Expectations of an improving economy and increasing rates have supported the dollar.

The Australian Dollar has had a tough time, with lockdowns in Australia and reduced orders from China. Going forward, Australia seems to be coming through the worst of the disruption and the Australian Dollar could make back some ground.

Although New Zealand has been the least affected by lockdowns and disruption, they are now following the path of others through vaccination. The central bank is keen to normalise rates and this could further support the Kiwi.

Despite an increase in the oil and commodity prices, the loonie has not seen much benefit. The supply disruptions have outweighed oil prices and inflation remains a concern, though the central bank does not look likely to act immediately.