Published: 19 January 2022

The rising oil price that made Norway’s krone the top currency performer in Q3 did not extend the same advantage to the Canadian dollar. In July and August, oil prices moved lower; only in September did they pick up, getting the CAD back onto its feet. By coincidence, the Loonie was unchanged against the euro over the three months.

Canadian manufacturers were at the same time helped and hindered by rising prices. Industrial product prices rose by an annual 16.8%, but raw materials went up by more than twice as much; 38.1%. Like other developed economies, Canada was hampered by global supply chain blockages as lockdowns ended and demand exploded.

Employment remained well-supported. The number of people in work increased for three straight months. That apparent job security did not translate into consumer spending: retail sales fell in three of the last four reported months and gross domestic product unexpectedly shrank by 0.3% in the second quarter.

As in many other countries, rising prices were an issue. Consumer price index inflation hit 4.1%, its highest level since 2003. Although house price rises moderated in the summer, they were still up by an annual 18.4%, according to Teranet.

In August, Prime Minister Justin Trudeau called a snap general election believing that he could regain an overall majority in the House of Commons for his Liberal party. It did not work out like that, and for a while, during the election campaign, it looked as though Mr Trudeau might lose the premiership.

In the end, the prime minister held onto his job, winning 159 of the 338 seats but failing to take the 170 necessary for an overall majority and losing the popular vote to the Conservatives, as he had two years earlier. Mr Trudeau is once again in charge of a minority government, but investors are not overly concerned, because they are back in a familiar place.

With an inflation rate of 3.5%, a point and a half above its 2% target, the Bank of Canada is in the same bind as most of its peers; above-target inflation and a historically low benchmark interest rate. In March last year, the BoC made three cuts to its target for the overnight rate, taking down from 1.75% to 0.25%, where it has remained ever since.

At its last policy meeting in early September, the BoC kept its benchmark rate at “the effective lower bound” (it cannot go any lower). In its statement, the bank pointed out that “GDP contracted by about 1% in the second quarter” (and it shrank by a further 0.1% in July).

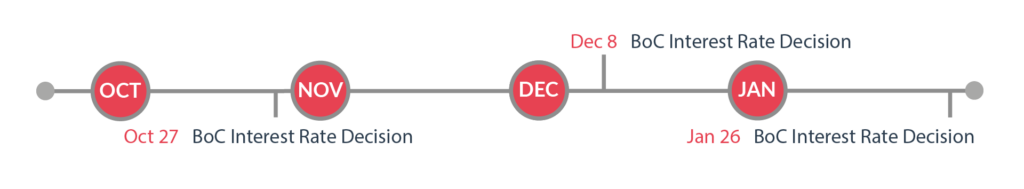

The central bank “will continue to provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation objective” and it is unlikely that there will be any tightening of monetary policy when the Governing Council next meets on 27 October.

Canada has also been hampered by supply disruptions, while the currency has not been buoyed by rising oil prices. Against the pound, the loonie has held in a tight range between 1.70 and 1.75 with a similar range being the average forecast. Political and supply uncertainties give rise to a wide range of forecasts, with the majority being for a stable to appreciating Canadian dollar.

Canada has also been hampered by supply disruptions, while the currency has not been buoyed by rising oil prices. Against the pound, the loonie has held in a tight range between 1.70 and 1.75 with a similar range being the average forecast. Political and supply uncertainties give rise to a wide range of forecasts, with the majority being for a stable to appreciating Canadian dollar.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

The European Union has also been hit by supply constraints and rising inflation, though the European Central Bank seems most keen to look through these issues. As the slowest to move, the euro may remain on the back foot.

Rising inflation and rebounding employment and economy are pushing the Federal Reserve to reducing asset purchases this quarter. Expectations of an improving economy and increasing rates have supported the dollar.

The Australian Dollar has had a tough time, with lockdowns in Australia and reduced orders from China. Going forward, Australia seems to be coming through the worst of the disruption and the Australian Dollar could make back some ground.

Although New Zealand has been the least affected by lockdowns and disruption, they are now following the path of others through vaccination. The central bank is keen to normalise rates and this could further support the Kiwi.

The UK continues to be affected by supply disruptions. Whilst the economy has continued to rebound almost to pre-pandemic levels, significant risks remain. The BoE are likely to raise rates sooner which could support sterling.