Published: 19 January 2022

Many factors, mostly external, came into play to make life difficult for the Aussie. Their effect was to knock the currency back into last place among the majors for the three months, with an average loss of just over 2%.

Australia’s biggest customer, China, consistently failed to tick the “growth” boxes that investors craved. It was not that China’s economy was failing, but that the double-digit increases were not to be seen. A specific problem was manufacturing and reduced demand for Australia’s mega-export; iron ore. In September, the price of the commodity was down by 50% from its May peak.

As ever, the Australian employment data were perplexing. In August, paradoxically, the loss of 145k jobs nevertheless led to a fall in the rate of unemployment. Because of the pandemic some positions were temporarily non-existent, so those who might have filled them were removed from the calculation.

Rising prices were all around. House prices rose to a record high despite erratic demand. Inflation rose to 3.8% in the second quarter. At the same time, retail sales fell four months in succession from June to August.

Australia continues to receive criticism of its approach to Covid vaccinations. At the last count, 46% of the population was fully vaccinated, a statistic that puts the country in 31st place out of 38 in the OECD group of developed countries.

Gladys Berejiklian, an ally of Prime Minister Scott Morrison, resigned as premier of New South Wales at the beginning of October. She did so after the Independent Committee Against Corruption said it was investigating “a breach of public trust” in a personal relationship with another MP.

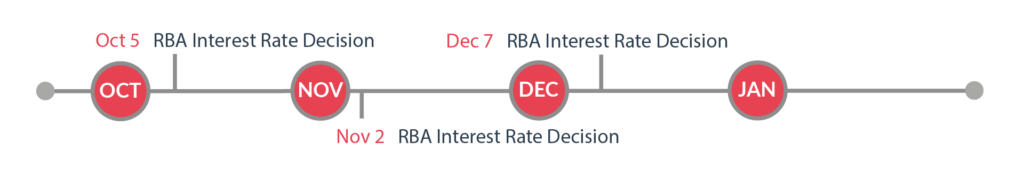

The Reserve Bank of Australia will not be taking interest rates higher before 2024. Investors have been forced to accept that line because the RBA has said so more than once, most recently following its policy meeting in early October.

The RBA has nevertheless stuck to its decision to reduce the pace of quantitative easing purchases. It has cut the monthly pace from $5bn to $4bn a month.

Unlike the Reserve Bank of New Zealand, rising house prices are not within the remit of the RBA. Governor Philip Lowe made clear in September that using interest rates to cool the housing market is “not on our agenda”.

The Aussie dollar has generally had a difficult quarter. A combination of reduced orders from China and increased disruptions and lockdowns in Australia have dented the economy. The move towards vaccination has started to turn the tide and may see the Aussie dollar make further gains. Again the wide range of forecasts reflects the degree of uncertainty in the future path of the economy and disruptions due to Covid, with 1 year forecasts from above 2.00 to below 1.70.

The Aussie dollar has generally had a difficult quarter. A combination of reduced orders from China and increased disruptions and lockdowns in Australia have dented the economy. The move towards vaccination has started to turn the tide and may see the Aussie dollar make further gains. Again the wide range of forecasts reflects the degree of uncertainty in the future path of the economy and disruptions due to Covid, with 1 year forecasts from above 2.00 to below 1.70.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

The European Union has also been hit by supply constraints and rising inflation, though the European Central Bank seems most keen to look through these issues. As the slowest to move, the euro may remain on the back foot.

Rising inflation and rebounding employment and economy are pushing the Federal Reserve to reducing asset purchases this quarter. Expectations of an improving economy and increasing rates have supported the dollar.

The UK continues to be affected by supply disruptions. Whilst the economy has continued to rebound almost to pre-pandemic levels, significant risks remain. The BoE are likely to raise rates sooner which could support sterling.

Although New Zealand has been the least affected by lockdowns and disruption, they are now following the path of others through vaccination. The central bank is keen to normalise rates and this could further support the Kiwi.

Despite an increase in the oil and commodity prices, the loonie has not seen much benefit. The supply disruptions have outweighed oil prices and inflation remains a concern, though the central bank does not look likely to act immediately.