Published: 19 January 2022

Economic sentiment in New Zealand began the third quarter better than it ended it. NZIER’s Quarterly Survey of Business Opinion at the end of Q2 opened with “a strong pickup in demand and confidence”. At the end of Q3, that had become “a weakening in business confidence despite demand holding up”.

The Covid situation had much to do with it. Despite the government’s massive effort to shut out the virus from the island nation, it still managed to get through, necessitating lockdowns first in Auckland then nationally. Business NZ’s performance indices were both markedly negative in September, with manufacturing at 40.1 and services at an even more miserable 35.6 on a scale where 50 represents stagnation.

The most important official economic indicators, which come out quarterly, related to Q2. They showed a sharp fall in unemployment and underutilisation, with a 13-year low of 4% for unemployment, and a 10-year high for inflation, with the headline rate at 3.3%.

As an example of how statistics can mislead, visitor arrivals in June 2021 (51.6k) were up by 1,375% over the same month last year (3.5k). The difference was caused by last year’s closed borders and a relaxation this year in AU-NZ travel restrictions.

Covid evasion and, latterly, acceptance was the thread running through NZ politics in Q3. It began with the Prime Minister Jacinda Ardern clinging to her belief that New Zealand could lock out the virus by closing its borders. It ended with the dawning realisation that the plan was unrealistic and that only a full-blooded vaccination programme would be appropriate for the future.

In early October, the prime minister announced that the Covid elimination strategy would be abandoned. With 40% of residents currently double-vaccinated, the jabbing will accelerate to cover 90% of the population. At that point, the lockdowns will end.

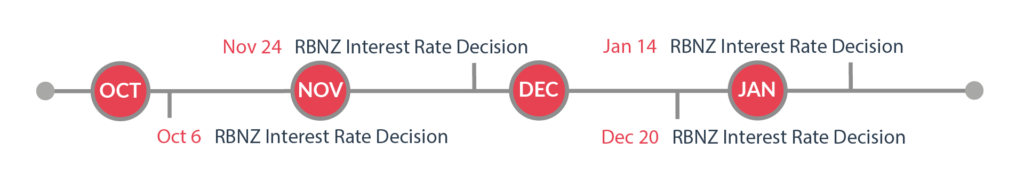

Like its peers, the Reserve Bank of New Zealand made no change to monetary policy in the third quarter. However, it did make a move in early October in time to find its way into this report.

In early August, Governor Adrian Orr said the RBNZ “needs to think about when and how we would return interest rates to more normal levels”. Investors took this as a signal that there could be an early increase to the Official Cash Rate. Then a positive test for Covid prompted a lockdown in Auckland. The central bank pulled its punch at the August policy meeting, but hinted that this was no more than a postponement.

At its early October policy meeting the bank did the deed, doubling the OCR to 0.5%, its first upward move in seven years. Economists polled by Reuters expect the benchmark rate to continue higher, reaching 1.5% by the end of 2022.

It is important to bear in mind that the RBNZ is nowadays mandated by the government to pay attention to house prices, which rose 2% in August and were up by 31.1% on the year. Interest rate increases alone will not stop their rise but can play a part.

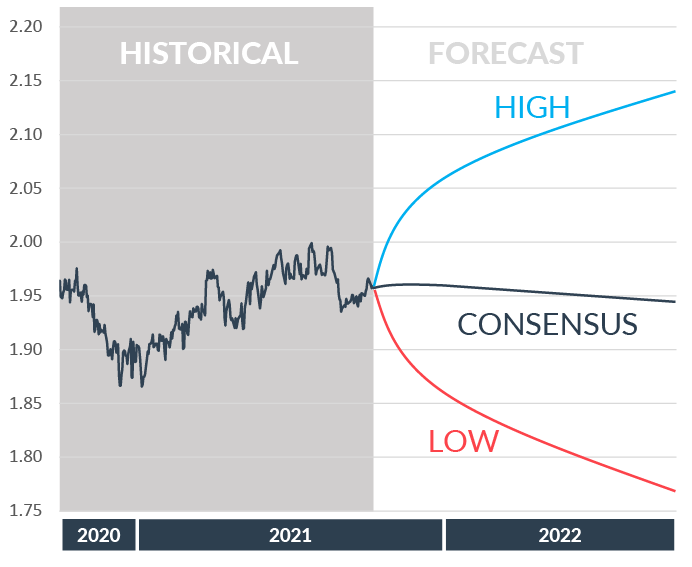

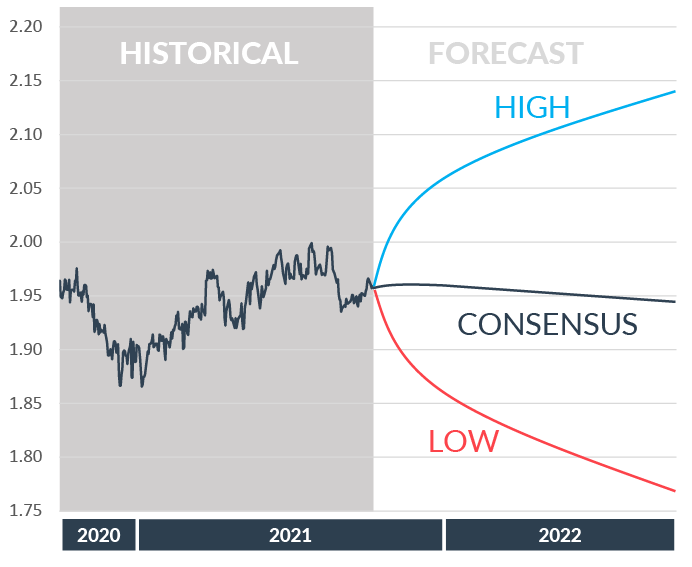

Compared with Australia, New Zealand has had a far calmer quarter. The currency has traded between 1.94 and 2.00. Having evaded Covid for most of the pandemic, New Zealand is now following a similar path to Australia having had to go through national lockdown. The central bank has signposted a move in rates and markets expect to see Kiwi strength in the medium term. The wide range of forecasts again reflects the uncertain global outlook.

Compared with Australia, New Zealand has had a far calmer quarter. The currency has traded between 1.94 and 2.00. Having evaded Covid for most of the pandemic, New Zealand is now following a similar path to Australia having had to go through national lockdown. The central bank has signposted a move in rates and markets expect to see Kiwi strength in the medium term. The wide range of forecasts again reflects the uncertain global outlook.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

The European Union has also been hit by supply constraints and rising inflation, though the European Central Bank seems most keen to look through these issues. As the slowest to move, the euro may remain on the back foot.

Rising inflation and rebounding employment and economy are pushing the Federal Reserve to reducing asset purchases this quarter. Expectations of an improving economy and increasing rates have supported the dollar.

The Australian Dollar has had a tough time, with lockdowns in Australia and reduced orders from China. Going forward, Australia seems to be coming through the worst of the disruption and the Australian Dollar could make back some ground.

The UK continues to be affected by supply disruptions. Whilst the economy has continued to rebound almost to pre-pandemic levels, significant risks remain. The BoE are likely to raise rates sooner which could support sterling.

Despite an increase in the oil and commodity prices, the loonie has not seen much benefit. The supply disruptions have outweighed oil prices and inflation remains a concern, though the central bank does not look likely to act immediately.