Published: 19 January 2022

By the end of the quarter, “supply chain issues” was almost as hot a topic in Europe as it was in Britain. Markit and Ifo employed nearly identical language to point out that supply “bottlenecks” were a brake on activity. After Markit’s composite purchasing managers’ index touched a 15-year high in July, supply and cost constraints took it lower in August and September. Both manufacturing and services were impeded by shortages of inputs.

They were also affected by higher costs. Industrial producer prices increased by 1.1% in August and were up by 13.4% on the year. The highest yearly increases were 54.8% in Ireland and 23.9% in Belgium. At the consumer level, there was also upward pressure on prices. Headline inflation in the euro area hit a provisional 3.4% in September, its highest level in 13 years.

Gross domestic product expanded by 2.2% in the second quarter and was 14.3% larger a year earlier. Even after that growth, output was still 2.5% below the pre-pandemic Q4 2019.

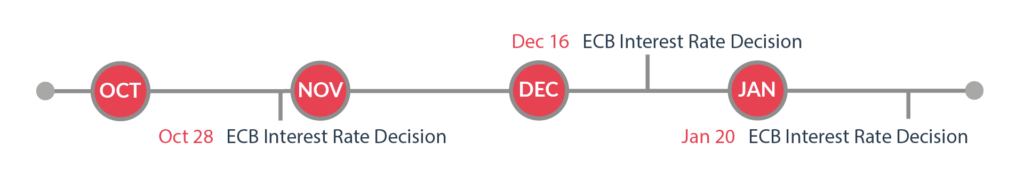

The euro has spent most of the last quarter falling against the US dollar. The combination of faster recovery and consequently higher expectations of interest rate hikes for the dollar has worked against the euro. The supply chain issues have hit the European figures as well as those of the UK. Forecasts are for the euro to stabilise and appreciate gradually against the US dollar, but this relies on the European economy and central bank catching up to others.

The euro has spent most of the last quarter falling against the US dollar. The combination of faster recovery and consequently higher expectations of interest rate hikes for the dollar has worked against the euro. The supply chain issues have hit the European figures as well as those of the UK. Forecasts are for the euro to stabilise and appreciate gradually against the US dollar, but this relies on the European economy and central bank catching up to others.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

The UK continues to be affected by supply disruptions. Whilst the economy has continued to rebound almost to pre-pandemic levels, significant risks remain. The BoE are likely to raise rates sooner which could support sterling.

Rising inflation and rebounding employment and economy are pushing the Federal Reserve to reducing asset purchases this quarter. Expectations of an improving economy and increasing rates have supported the dollar.

The Australian Dollar has had a tough time, with lockdowns in Australia and reduced orders from China. Going forward, Australia seems to be coming through the worst of the disruption and the Australian Dollar could make back some ground.

Although New Zealand has been the least affected by lockdowns and disruption, they are now following the path of others through vaccination. The central bank is keen to normalise rates and this could further support the Kiwi.

Despite an increase in the oil and commodity prices, the loonie has not seen much benefit. The supply disruptions have outweighed oil prices and inflation remains a concern, though the central bank does not look likely to act immediately.