Published: 6 July 2021

The flow of positive American economic data continued mostly undisturbed, but there were hiccups. It was the jobs numbers that most ruffled the dollar’s feathers. After strong showings for February and March, the key nonfarm payrolls figures for April and May fell well short of forecast. Even an above-forecast 850k increase in June, the biggest in ten months, left investors unimpressed because a large number of people seem to have left the labour market.

Inflation posed a different conundrum. Investors had been primed to expect it to rise to 4.7% in May, and they were fairly relaxed about the prospect. However, when it came in at 5% – a 13-year high – after a seventh monthly increase, eyebrows were raised. What would normally have been a positive number for the dollar, in fact, sent it lower, because the Fed is turning a blind eye to inflation.

House prices are still heading north. Data from the Federal Housing Finance Agency and Standard & Poors put the annual increase to April at 15.7% and 14.6%, respectively. The FHFA described the recent house price growth as “unprecedented”.

Although President Biden missed his target of vaccinating 70% of his people by Independence Day, the US project is pressing ahead, with 55% of them now in receipt of at least one jab. The problem he is now encountering is vaccine hesitancy, perhaps as a by-product of conspiracy culture.

The administration and his Democratic party came to power with a pledge to put serious money into the national infrastructure. Although it has been slow progress, some was made towards the end of June when the 50-50 Senate agreed an eight-year, $1.2 trillion bill to fund roads, bridges, the power grid, public transport and internet. There is a catch, though. The president wants another $6 trillion for his party’s ambitions on climate change, education and social care. He will not approve the first without the second, and that could be problematic.

Although it has not made any concrete changes to policy in recent months, the Federal Reserve has not been slow to set out its hopes and fears, what it will and will not do. For the Fed Chairman, at the top of this list comes “nothing”. Jerome Powell is firmly wedded to the idea that inflation is “transitory” and that the best approach is one of patience and caution.

Support for this stance is far from universal, and the goalposts are moving inexorably towards tighter monetary policy. Where Governor Christopher Waller said in late April that “There’s no reason to be pulling the plug on our support till we’re really through this”, two months later, he was “not ruling out” a rate hike next year if it were to be appropriate.

The supporting documentation for the most recent Federal Open Market Committee meeting showed seven of its members pitching at a 2022 rate increase. A majority expect one to happen by the end of the following year.

Vaccination levels in the US prompted President Biden to declare independence day as the end of pandemic restrictions. With the economy already recovering strongly, concerns continue to increase on the level of inflation.

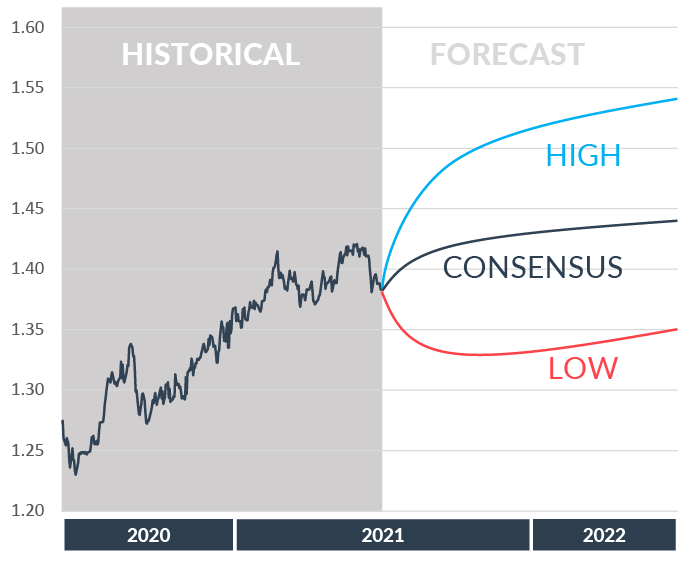

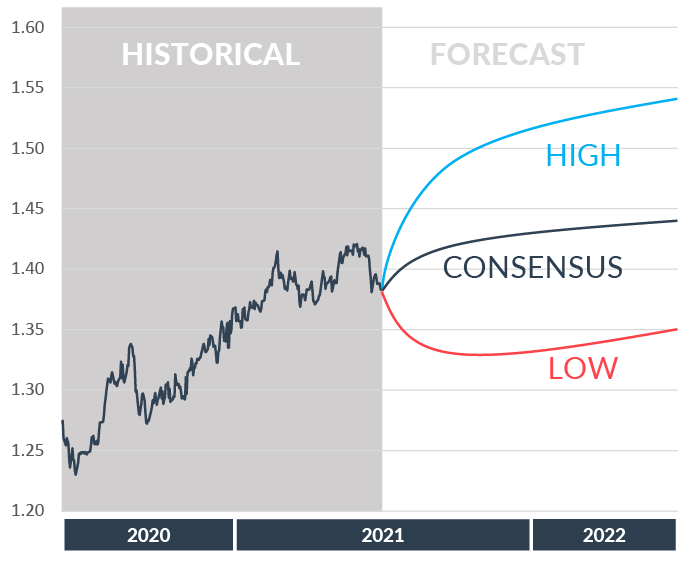

Whilst the Fed are content to wait for the moment, markets have brought forward rate hike expectations which halted an otherwise weak dollar. Having been at 1.43, we are now back in the high 1.30’s. Expectations are for a renewed push above 1.40 with many expecting 1.45 in a year.

Vaccination levels in the US prompted President Biden to declare independence day as the end of pandemic restrictions. With the economy already recovering strongly, concerns continue to increase on the level of inflation.

Whilst the Fed are content to wait for the moment, markets have brought forward rate hike expectations which halted an otherwise weak dollar. Having been at 1.43, we are now back in the high 1.30’s. Expectations are for a renewed push above 1.40 with many expecting 1.45 in a year.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.