Published: 6 July 2021

The Euroland economic data tended to exaggerate measures such as retail sales and production on an annual basis because of the “base effect”: extremely weak performance a year earlier, as a result of Covid lockdowns, made what would normally look like modest output look gains appear dramatically good. Confidence moved steadily higher in every sector: the European Commission’s own numbers showed economic sentiment hitting a 21-year high.

Gross domestic product data confirmed that Euroland had suffered a double-dip recession, with the economy shrinking 0.3% in the first quarter. Investors did not care: they were looking at the more current measures such as the purchasing managers’ indices. There were considerably more upbeat with the provisional composite measures from Germany and the euro area reaching 10- and 15-year highs respectively.

Inflation continued its upward stroll, reaching a provisional 1.9% in June. That fits exactly with the European Central Bank’s target of “just below but close to 2%”, and has no implications for interest rates.

After sitting on the back burner for a couple of months, the Next Generation Recovery Fund reappeared on the scene. After what must have been a great deal of horse-trading and arm-twisting, the European Commission announced in June that it was preparing a joint issue of Eurobonds in which every EU member will take part. As initially envisaged, the target is to raise €750 billion, €80 billion of it before the end of the year.

Europe’s Covid vaccination campaign is lagging Britain and the United States, but at least it is now moving. Just over half the population have had at least one injection. There is a considerable regional disparity across the continent because each member state is in charge of its own programme, and there are high levels of hesitancy in some areas.

The EU said at the end of June that it was considering limited concessions in the argument about UK trade with Northern Ireland. A three-month extension on sausages, and changes to the law about medicines and guide dogs are said to be in prospect.

At almost every opportunity, ECB President Christine Lagarde has stressed her intention to leave monetary policy unchanged until the economy is back on track and inflation is sustainably on target. There is no shortage of speculation about exactly what conditions will need to be in place before the money-printing stops and interest rates start to go up. One of the more popular interpretations is that the ECB could be looking at average inflation targeting, similar to the scheme said to be in force at the US Federal Reserve. Such a system would add a year of 1% inflation to a year of 3% inflation and average it out as 2%.

Ms Lagarde’s recent specific observations included an upbeat view of the economy “brightening”, with a “vigorous bounce-back”. Nevertheless, she said at the same time that to tighten monetary policy now would be “premature” and would “pose a risk to the recovery”.

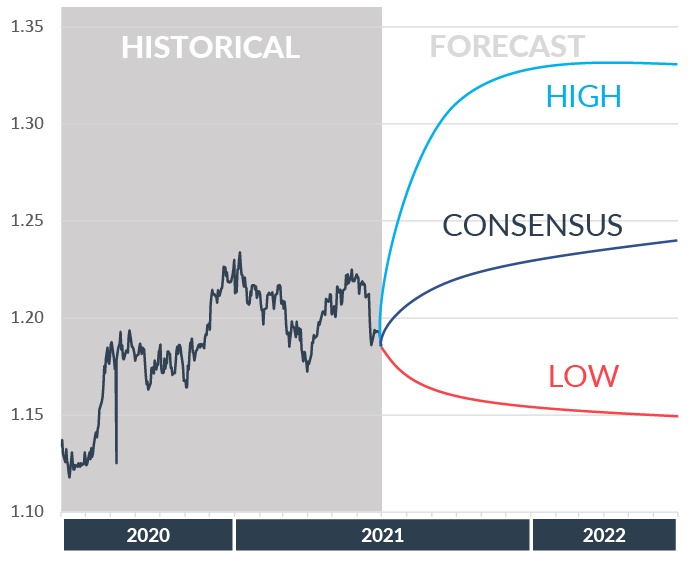

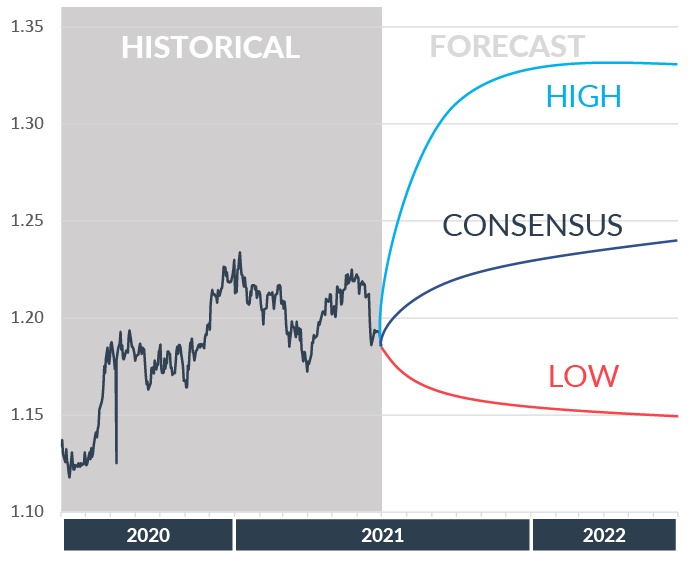

The euro spent the first half of the period gradually appreciating against the Dollar as the vaccine rollout gathered pace as the economy moves out of recession. However, the move higher was dented by the US Federal Reserve’s more hawkish outlook, based on a stronger US recovery.

Whilst back below 1.20, the majority of forecasters expected a continuation of the gradual appreciation of the Euro over the next few months, with 1.20 the initial target again.

The euro spent the first half of the period gradually appreciating against the Dollar as the vaccine rollout gathered pace as the economy moves out of recession. However, the move higher was dented by the US Federal Reserve’s more hawkish outlook, based on a stronger US recovery.

Whilst back below 1.20, the majority of forecasters expected a continuation of the gradual appreciation of the Euro over the next few months, with 1.20 the initial target again.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.