Published: 6 July 2021

The UK economic data were mostly solid. Although some looked wobbly on a monthly basis, just about all compared very favourably with the same month last year, when lockdowns were the order of the day. Investors dismissed the 1.6% fall in gross domestic product, confirmed in late June, as an irrelevance. The fear of hidden unemployment – concealed by the furlough scheme – continues to lurk, but the most recent data put it at 4.7% after five months of slow decline.

Rising prices are more of a concern. Headline inflation reached 2.1% in May, above the Bank of England’s medium-term target. House prices continued to forge ahead, with Rightmove reporting a “buying frenzy” and Bank of England Chief Economist Andy Haldane saying prices were “on fire”. Nationwide’s house price index rose 13.4% in the year to June.

The government continued to receive positive press coverage for the success of the NHS Covid vaccination programme. It was not, however, sufficient to guarantee universal support. In three parliamentary by-elections, the ruling Conservative party gained one seat from Labour, lost one to the Liberal Democrats and narrowly failed to win another. That failure might have had something to do with the release, days earlier, of footage showing Health Secretary Matt Hancock with an assistant in his office. Mr Hancock resigned, to be replaced by the erstwhile Chancellor Sajid Javed.

Relations with the EU seemed not to get any smoother. The Prime Minister’s Northern Ireland protocol, which puts a trade border down the Irish Sea, has become an apparently insuperable bone of contention for both Britain and the European Union. A “sausage war” blew up over the transport of processed meat from Britain to Northern Ireland, and the EU warned of economic sanctions if Britain does not uphold its side of the agreement. US President Biden also entered the spat, warning Britain not to endanger the Good Friday peace agreement.

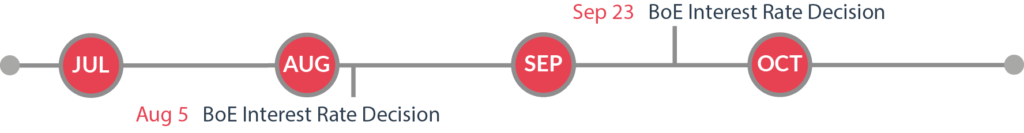

The Bank of England said in early May that it would reduce the pace of asset purchases. Monetary Policy Committee member Gertjan Vlieghe went a pace further to raise the possibility of an increase in Bank Rate next year, not to fight inflation but because the economy is picking up speed. His colleague Andy Haldane said the economy is already “going gangbusters”. Their boss, Governor Andrew Bailey, said, “let’s not get carried away” by the upgraded economic outlook.

For the time being, the Bank is toeing the same line as the Federal Reserve. Its official line is that the current spike in inflation is transitory, the result of very low prices 12 months ago. Almost no economist expects any change to interest rates this year.

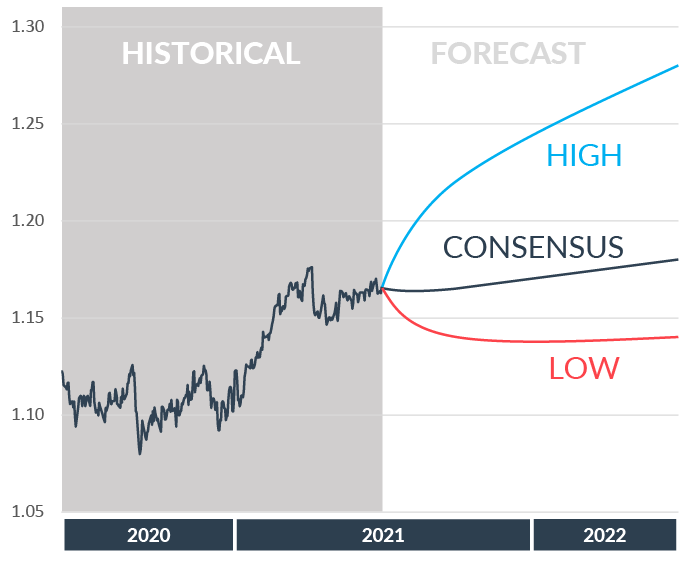

Whilst Brexit continues to cause issues moving goods in and out of the country, it has not dented enthusiasm for the pound. The ongoing success of the vaccine programme and the optimism around further growth as we move out of lockdown has boosted sterling.

Over the last quarter, the pound has remained in a relatively tight range between 1.1450 and 1.18, but most forecasts suggest we are likely to continue to push higher. The next target is to take out 1.18.

Whilst Brexit continues to cause issues moving goods in and out of the country, it has not dented enthusiasm for the pound. The ongoing success of the vaccine programme and the optimism around further growth as we move out of lockdown has boosted sterling.

Over the last quarter, the pound has remained in a relatively tight range between 1.1450 and 1.18, but most forecasts suggest we are likely to continue to push higher. The next target is to take out 1.18.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.