Published: 6 July 2021

New Zealand’s monthly Business Outlook was less ebullient than the Australian editions. In early June, “all activity indicators were generally lower”, and at the end of the month, business confidence was three points lower at -0.6 as inflation pressures remained “intense” and “retail pricing intentions soared”.

After a hiccup in the first quarter, the NZIER index of business confidence continued to improve in Q2, rising 20 points to 7, and the first positive reading since autumn 2017. ANZ’s monthly measure of consumer confidence was less remarkable, losing a point and a half over the three months and still not back up to pre-pandemic levels at 114.1. Westpac’s take on consumer confidence delivered a five-month high of 107.1, comfortably within the range seen in 2019.

House prices continued to fly. The national index from REINZ rose 29.8% in the year to May. Regionally, the smallest increase was the 17.7% seen in Queenstown – Lakes District and the largest 62.7% in Palmerston North City. From five years ago, the national increase was 9.3%.

The suspension of the Trans-Tasman travel bubble is expected to end imminently for some Australian states, but local specialists are suspicious that it might not last long. University of Auckland epidemiology professor Rod Jackson said the Government should be prepared to suspend the bubble at the first sign of community transmission across the ditch, and travellers needed to be aware they could be stranded at a moment’s notice. New Zealand has no intention of widening the catchment area for visitors, and the prime minister describes foreign (British) moves to end travel restrictions as “experiments.

That could have something to do with the glacial pace of vaccinations in NZ. In early July, only one in seven people – 14.6% – had had one or more jabs, fewer than Albania and Kazakhstan.

Reserve Bank of New Zealand Governor Adrian Orr is part of the “transitory” club, those central bankers who see no danger in a short-term inflation spike. His last official word on the matter was that rate hikes would be “conditional on the economic outlook”.

Investors nevertheless do their best to find evidence of secret hawkishness within every RBNZ statement. They were not convinced when the bank’s May statement offered the possibility of a lower Official Cash Rate if circumstances warranted. Their latest leap in that direction came after the NZIER’s Quarterly Survey of Business Opinion reported a sharp increase in confidence.

The New Zealand dollar continues to struggle, with a weaker economic outlook and a slow vaccine rollout not adding confidence. The central bank has even suggested that lowering rates may be required, in contrast to most central banks thinking about raising rates.

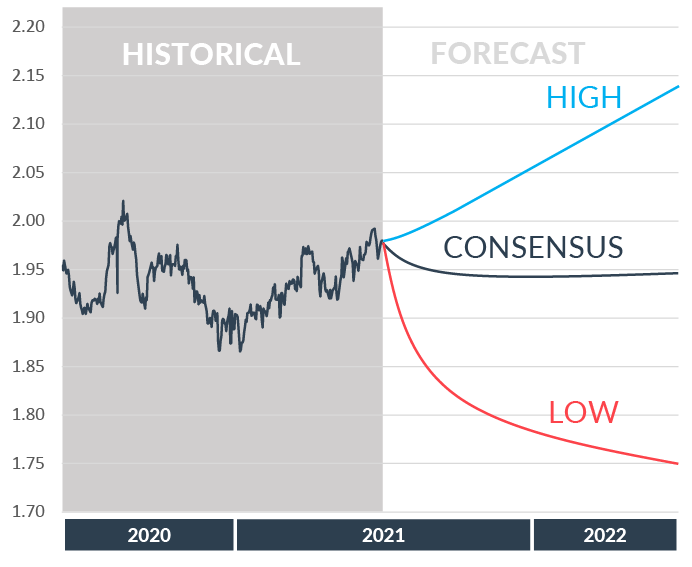

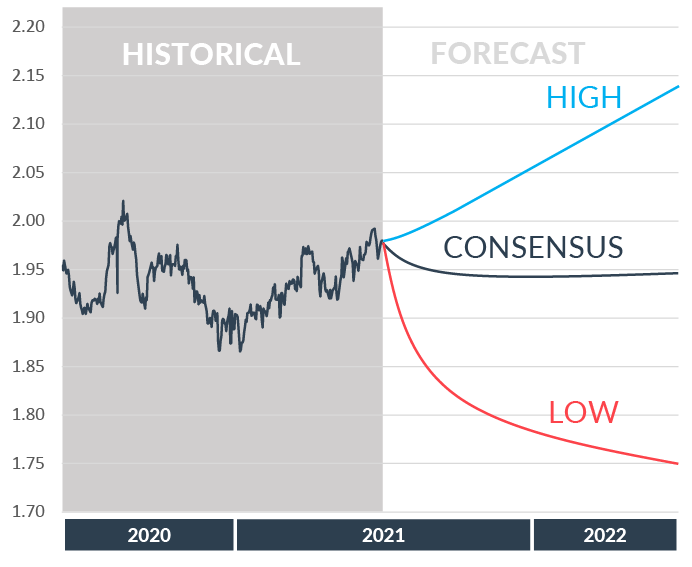

We have seen the Kiwi dollar continue to weaken towards the 1-year highs around 2.00. As with the Aussie dollar, the range of forecasts is wide, though in the short term a test of 2.00 looks likely.

The New Zealand dollar continues to struggle, with a weaker economic outlook and a slow vaccine rollout not adding confidence. The central bank has even suggested that lowering rates may be required, in contrast to most central banks thinking about raising rates.

We have seen the Kiwi dollar continue to weaken towards the 1-year highs around 2.00. As with the Aussie dollar, the range of forecasts is wide, though in the short term a test of 2.00 looks likely.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.