Published: 6 July 2021

Investors were selective about which Canadian ecostats they chose to take notice of and which to ignore. Surprisingly, they paid no attention to a 3.6% headline rate of inflation, the highest in ten years. To be fair, most of the other statistics made little immediate difference to the Loonie either.

The most interesting numbers were still, however, those that related to prices. Raw material and industrial product prices became increasingly spectacular through the quarter. Data reported in June put raw material costs 40.1% higher on the year and showed factory gate prices rising 16.4%. Lumber was up by a startling 235.5% on the year.

House prices were strong, with existing homes up by an annual 10% and 12%, according to Statistics Canada and Teranet. New home prices rose 11.3% in the year to May, the biggest increase since 2006.

Oil continued to support the Canadian dollar, rising steadily through the quarter. WTI crude touched a seven-year high in early July, partly as a result of an impasse on production within OPEC.

Three months ago, the observation here was that Canada was dragging its feet on Covid vaccinations, with only 12% of Canadian receiving at least one dose compared to 30% in the United States. That situation has since been turned around, with the numbers for early July putting Canada on 68.5% and the States on 54.5%.

The most disturbing political story related to the indigenous children who were forced in the 19th and early 20th centuries to attend church-run residential schools. In May and June, the remains of hundreds of them were found near four schools. Thousands more remain missing.

Rather more heartening was the news that in mid-June, the House of Commons passed a budget bill, the first for two years. It included measures to “finish the fight against Covid 91”, “create jobs and growth”, and promote a “resilient and inclusive recovery”.

After its policy meeting in March, with the most recent measure of inflation sitting at 1.1% for February, the Bank of Canada said that it expected inflation to rise to the top of its 1% – 3% target range “in the next few months”. It should not, therefore, have been too much of a shock to the central bank to see it at 3.6% for May.

The BoC was already on the case, though. Setting a pace for its peers, the BoC announced in April that it would wind down weekly asset purchases from $4 billion to $3 billion. The tapering decision would also have been influenced by the bank’s upgraded forecast for the domestic economy.

Governor Tiff Mecklem has continued to insist that it will not increase its benchmark interest rate “until economic slack is absorbed so that the 2% inflation target is sustainably achieved”, which he thinks could happen by the end of next year.

The rising in raw materials, the oil price in particular has supported the Canadian dollar. This has been helped by a more hawkish central bank, reducing asset purchases already to dampen inflation expectations with the economy looking strong.

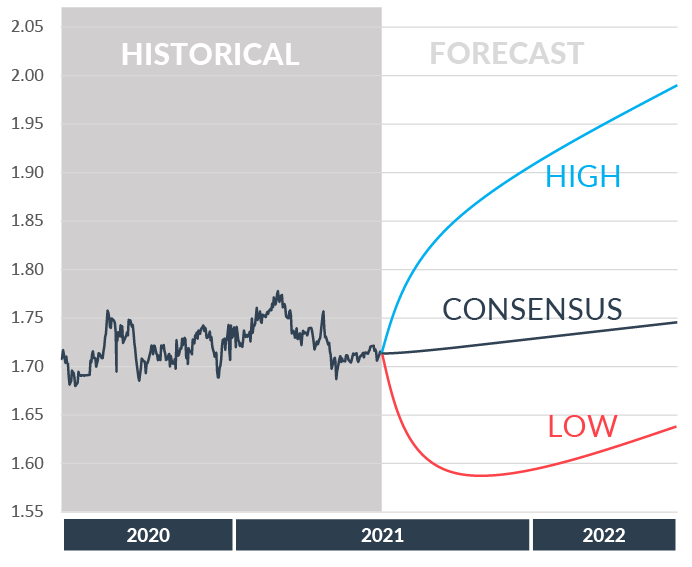

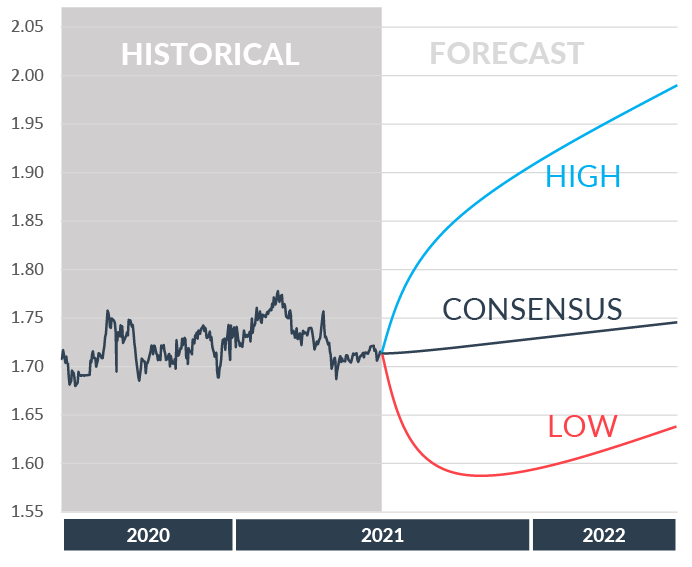

The Canadian dollar has had a strong quarter, holding towards recent lows around 1.70. Going forward the forecast range is high, reflecting uncertainty around the path of raw materials and the less positive Covid vaccination situation.

The rising in raw materials, the oil price in particular has supported the Canadian dollar. This has been helped by a more hawkish central bank, reducing asset purchases already to dampen inflation expectations with the economy looking strong.

The Canadian dollar has had a strong quarter, holding towards recent lows around 1.70. Going forward the forecast range is high, reflecting uncertainty around the path of raw materials and the less positive Covid vaccination situation.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.