Published: 6 July 2021

The Monthly Business Surveys from NAB painted a consistently bullish picture of the Australian economy. April’s edition said, “business conditions rose to a record high in March, driven by strong increases in all sub-components – which are now also all at record highs”. In May, there was “another very strong result” with business conditions and business confidence at record highs. Last month the survey “continued to point to strong outcomes in the business sector, with business conditions resetting their record high for the second month in a row”.

New home sales once again provided the most entertaining statistics. The figure released in April, relating to sales in March, showed a monthly increase of 90.3%, in April sales fell 54.4%, and in May they were up by 15.2%. As before, the wild swings related to the wind-down of the government’s HomeBuilder subsidy.

At a more fundamental level inflation, which is only reported every three months, rose to 1.1% in the first quarter from 0.9% in Q420. Gross domestic product expanded by 1.8% over the same three months. Employment, which has been all over the place since the advent of the pandemic, increased by a net 161.6k over the quarter.

Australia’s Covid vaccination programme is still not going smoothly, with just under a quarter of the population having received one or more doses. Brad Hazzard, the New South Wales health minister, summarised it thus: “Until we get enough vaccine and enough GPs actually at the frontline able to provide that vaccine into arms, we will continue to have effectively the Hunger Games going on here in NSW”.

Australia was one of the first countries to secure a free trade deal with the United Kingdom, and it is seen locally as a triumph. When it comes into force, the agreement will eliminate all tariffs and quotas except, for some reason, long-grain rice.

The Reserve Bank of Australia followed roughly the same course as its peers in London, Washington and Frankfurt. Aside from any near-term spike, which Australia has not yet seen, “the pick-up in inflation and wages growth is expected to be only gradual and modest”.

In early July, the RBA statement reiterated the reassurance that “it will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The Bank’s central scenario for the economy is that this condition will not be met before 2024.”

Nevertheless, the RBA does seem ready to tinker with quantitative easing. The current programme, which finishes in September, will be followed by a much smaller and shorter-term version that could end as soon as November.

The economy in Australia has generally held up well, with levels of Covid kept to a minimum, and strong restrictions at borders. Concerns remain over the vaccine rollout and the potential damage to the economy of longer term restrictions.

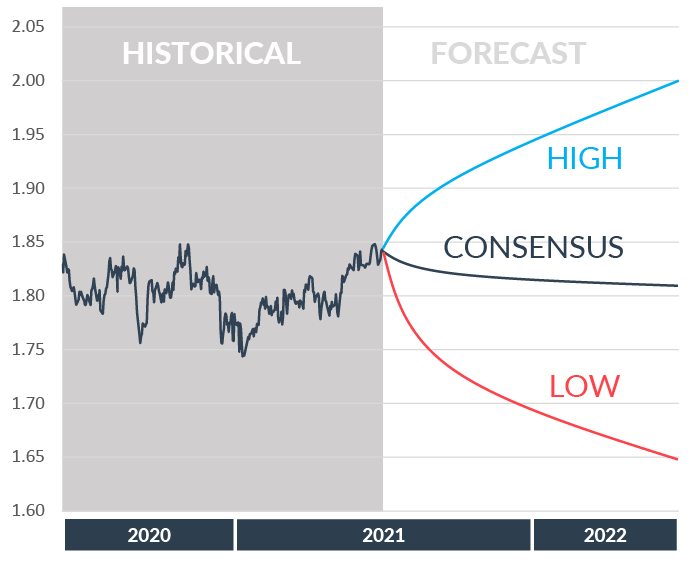

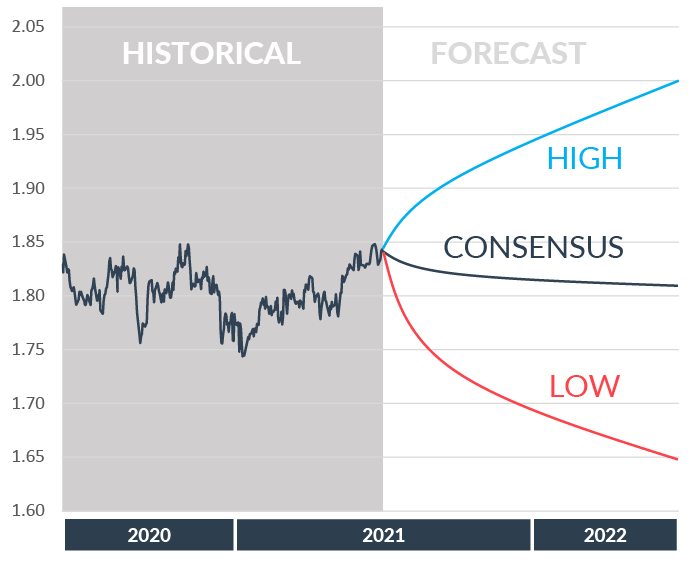

The Aussie dollar has gone from a stronger performer to a weakening bias through the quarter, testing 1-year highs of 1.85 against the pound. The forecasts are particularly broad with a high degree of uncertainty around next steps for the economy relative to others.

The economy in Australia has generally held up well, with levels of Covid kept to a minimum, and strong restrictions at borders. Concerns remain over the vaccine rollout and the potential damage to the economy of longer term restrictions.

The Aussie dollar has gone from a stronger performer to a weakening bias through the quarter, testing 1-year highs of 1.85 against the pound. The forecasts are particularly broad with a high degree of uncertainty around next steps for the economy relative to others.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.

Currency market volatility could have a significant impact on your transfer costs. Hawk FX provide expert guidance to ensure you are protected and get the best rate.

Talk to us about how market volatility will affect you directly and how we can help. Complete this form or call us on +44 (0)330 380 30 30.