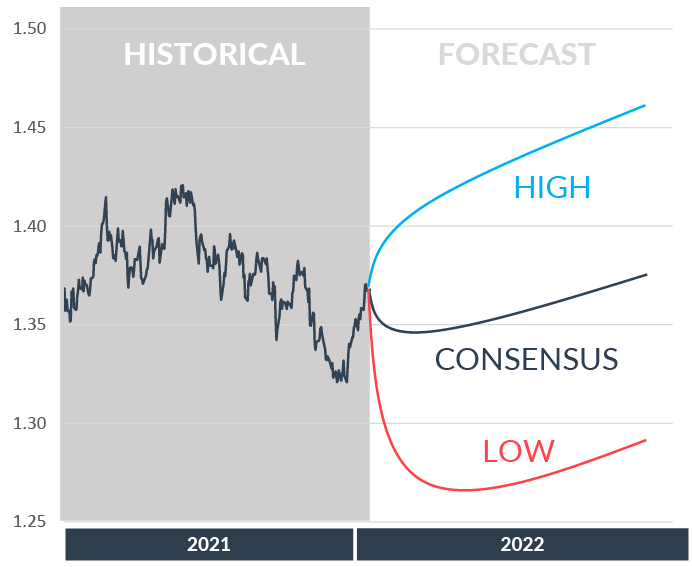

Make sure your business is ready for FX volatility ahead, get a health check

An expert analyst with ten years experience will provide a detailed Business Exposure Report. The health check evaluates your business’s ability to meet FX volatility challenges and provides actionable plan for your business.