Whilst the other major central banks have meetings this week, we will have to wait until next Thursday to hear from the Bank of England. The main data that will be of interest this week is the PMIs. The readings for manufacturing and services are second readings. Manufacturing remained at the previous level, with Services expected to improve further into growth territory. The construction PMI is forecast to show moderate growth in line with the previous reading.

The only other data of interest will be the mortgage lending data, which is expected to show continued weakness in the housing market. The data this week is unlikely to shift market expectations of a further 0.25% hike next week by the Bank of England.

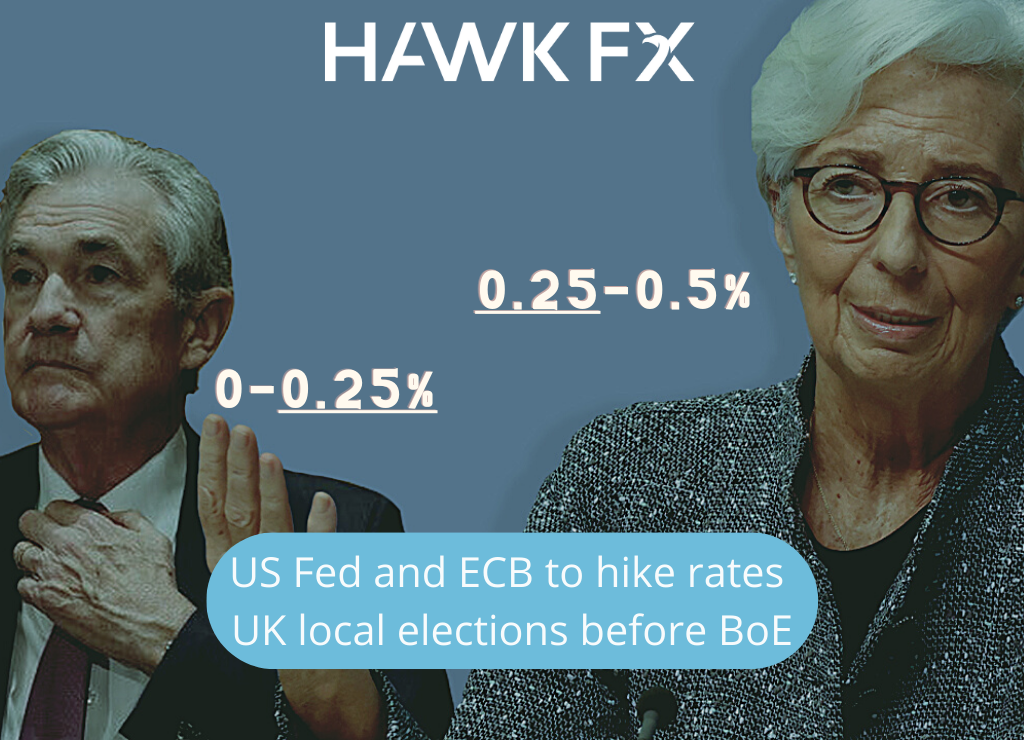

Local elections this week are likely to see a swing away from the ruling Conservatives and towards Labour. Forecasts from Polling Council members suggest the swing will lead to Labour picking up a significant number of seats. The Conservatives are likely to control a larger number of contested councils. There will no doubt be an extrapolation of the results towards the General Election to be called in 2025.

GBPEUR – 1.1376

GBPUSD – 1.2495

The European Central Bank is expected to raise interest rates again on Thursday. Most economists expect a 0.25% rate hike, though there is a chance the ECB may increase by 0.5% to stem inflation. Recent Eurozone GDP data showed weaker-than-expected 0.1% growth in the first quarter, with a contraction at the end of 2022.

The latest Eurozone CPI inflation data was released today, ahead of the decision, and showed inflation and Core inflation both remaining sticky at 7% and 5.% respectively. This follows a larger fall due to the reduction in energy prices. The fact that inflation has barely moved lower in April may spur the ECB to take a more aggressive approach.

Following an expected hike this week, markets expect further rate hikes from the European Central Bank, in June and potentially again in July. There will be a great deal of interest in any forward guidance from the meeting. We expect any further moves to be “data dependent” and affected by their view of any worsening of credit conditions.

EURUSD – 1.0984

EURGBP – 0.8790

As we come into another rate decision from the Federal Reserve, the markets have been volatile. There was further concern about the banking section as First Republic became the fourth bank to fail. JP Morgan took over First Republic assets, which may have contained the runs on major institutions for now. There remains concern about other smaller institutions and how they may fare if the asset outflows continue.

Against this backdrop of banking stress and talk of recession, the US Federal Reserve is still expected to raise interest rates for the tenth time in a row, by 0.25%. Given the slowing growth shown in the recent GDP data and the risk of further contagion in the banking sector, there could be a case for a pause. Most expect the widely expected 0.25% hike, with a potential change in tone to suggest the Fed may then pause.

We round out a busy week for US data with the employment report. This is likely to show a continued strong picture with a further 200k jobs added. The unemployment rate will likely remain around 3.5%, whilst wage inflation is expected to remain at a similar level around a 0.3% increase for the month. The US dollar has been under pressure against sterling and the euro, though it rallied at the end of last week. touching new lows for the year against the latter but has picked up today.

GBPUSD – 1.2495

EURUSD – 1.0984

Do get in touch if you would like to discuss this further.

*Interbank rates are correct at 7am on the date of publishing.