The Brexit day is fast approaching, and after the hiatus of a prorogued Parliament and then a Supreme Court intervention and now a frosty reception from EU stakeholders about the Government’s Brexit deal proposals, a certain outcome for the 31st of October remains highly uncertain.

To help, we have pulled together some ideas of what you can expect from the currency markets in all three eventualities: deal, no deal, or extension.

We are all well aware of the reaction should no deal be agreed between the EU and the UK by Oct 31 – the pound will likely plunge. According to a Bloomberg News survey of 18 foreign-exchange strategists and investors, Sterling would drop to $1.11 from current levels. Furthermore, if no-deal becomes more certian before the Brexit date, then the sell-off would take place in advance of Oct 31st and the drop to $1.11 would not be as sudden.

But, if the negotiation between the EU, the UK Government and UK Parliament go down to the last minute, either because of legal procedure or a last-ditch attempt to push a deal through, then the shock will be greater. In a Bloomberg article, Stephen Gallo, head of European currency strategy at BMO Capital Markets, is quoted saying: “The ‘knee-jerk’ reaction in the pound to a no-deal would probably see it drop to $1.10-$1.15.” And, Jane Foley, head of currency strategy at Rabobank, is quoted saying: “Such an outcome isn’t priced into the pound. If we do have a hard Brexit we will see a very strong initial tumble in sterling.”

On the flip side, should a deal be agreed between the UK and the EU by Oct 31st, then the pound would likely regain the drop it has seen across currencies. Strategist Petr Krpata of ING Groep NV is quoted by Bloomberg suggesting: “A relief rally in sterling to around $1.34 (a 9% gain).”

Once a deal has been struck, however, the attention of markets would turn to the fundamentals of the UK economy and also the challenges the UK would face in negotiating future trade deals with the EU. Fundamentals of the UK economy have signalled in Q3 2019 that some damage has already been wrought on an economy sagging under the weight of relentless uncertainty, another looming Brexit deadline, and deteriorating global economic conditions amid heightened trade tensions.

Therefore, once a deal has been struck, positive developments for the UK economy and trade deal negotiations with the EU are essential for the UK pound to maintain the gains it has made as a result of securing a Brexit deal.

In the event of an extension, another delay to Brexit would undoubtedly be taken better by markets than a no-deal exit, but it still wouldn’t solve the problem. The prospect of a general election, uncertainty among EU Leaders regarding the current Government’s Brexit plans, and the chance that an extension may be as short as a week all add to the confusion a delay would grant markets. The UK economy is beginning to show side effects created by unknown future political and trade developments between the EU, the UK Government, and the UK Parliament.

Therefore, an extension would likely lead to further weakening of the UK economy (dependent upon the length) and currency markets would continue to speculate on the U.K.’s future relationship with the EU, so you should expect the same activity seen in currency markets since the previous extension.

While averaging forecasts is one method to visualise the outcome of Oct 31st. Value at Risk or VaR, a statistical measure, is a useful tool that can forecast your the potential loss during the period.

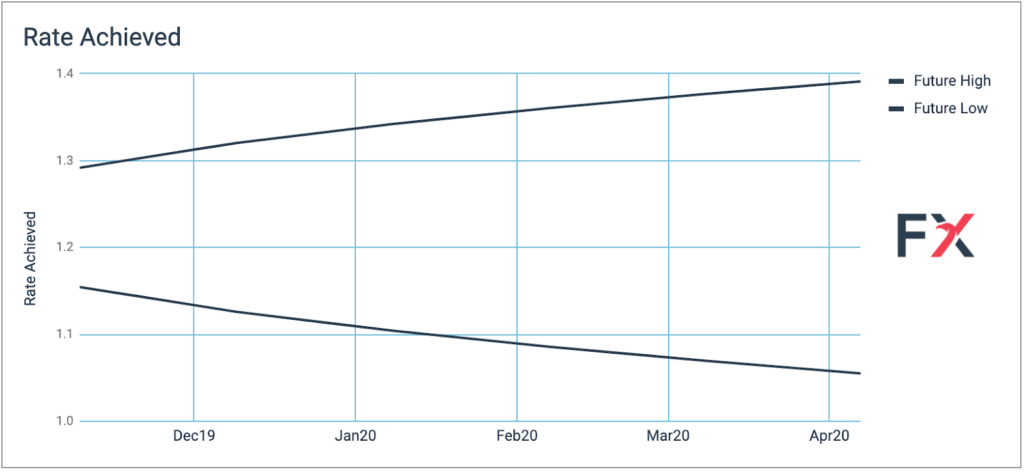

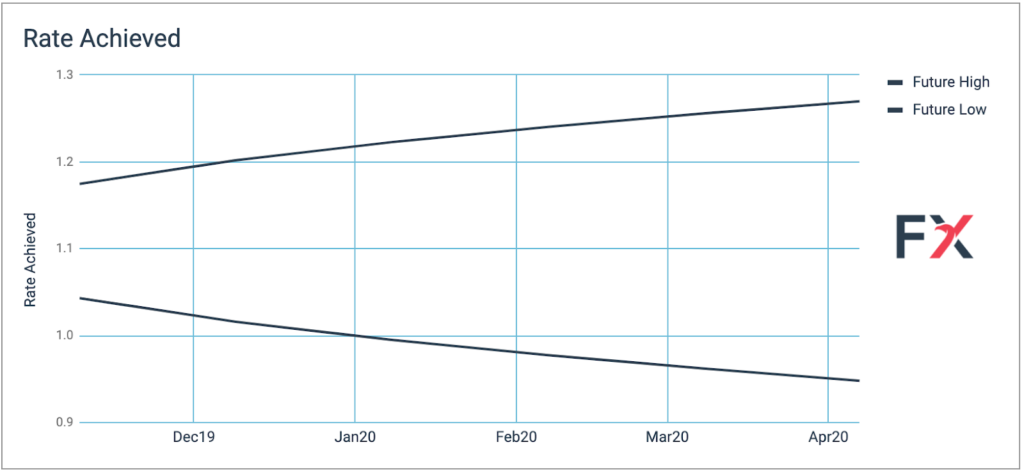

The two charts below give you an idea of what rate you can expect to achieve over the next 6 months if you have not hedged your currency exposure when trading the Pound against the Dollar or the Euro. The black lines represent the rate you could achieve over the next 6 months in 99% of all scenarios.

Depending on your exposure and the rates you need to achieve over the next 6 months, if the amount of uncertainty in a no hedge scenario is too much for you to tolerate then you should consider a hedge to protect your risk of financial loss. Alternatively, if you would like to find out what rate you could achieve over the next 6 months with your current hedges in place while accounting for all three Brexit scenarios, then please get in touch and we can calculate this for you.

In summary, the outcome of 31st of October is still unknown and the currency markets could react in many different ways dependent on the outcome. If you would like some further assistance in understanding how you should trade the three possible Brexit scenarios, then feel free to get in touch.