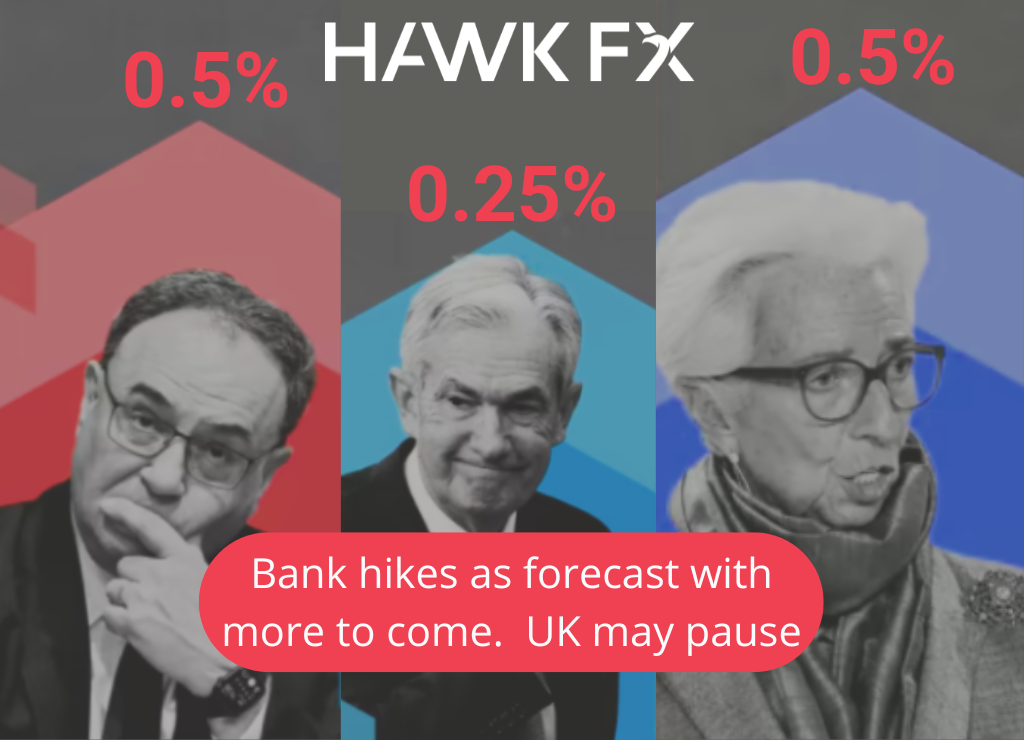

Last week, we had a busy week of central bank updates and rate hikes. The message from all of the central banks was that inflation has probably peaked providing another lift to market sentiment. That has reinforced market expectations that interest rates are close to or at a peak. The rate hike of 0.5% by the Bank of England was as the markets expected. The panel stressed that inflation is still well above their target and there are upside risks not least from a tight labour market. The BoE seemed to suggest that rates may have peaked, warning of further tightening if inflationary pressures prove more persistent.

With fewer data out this week, attention will be given to follow-up comments from central bank policymakers. Catherine Mann suggested that we may need a further rate hike at the next meeting, suggesting that the Bank shouldn’t stop hiking too soon. BoE Governor Bailey and some MPC colleagues will also testify to a parliamentary committee. This will give policymakers the chance to address any questions in the market related to their latest moves.

This week, we will get the data for December and the fourth quarter GDP. The November figure showed an unexpectedly small rise, which may keep the figure for the quarter in growth territory. That would mean that the UK will avoid a technical recession, at least for now. We forecast a drop of 0.1% for December which would leave growth small but positive for the quarter. We will saw the January PMI construction report, yesterday, which was in line with the last month and showed a slight further contraction in activity.

GBPEUR – 1.1214

GBPUSD – 1.2044

The European Central Bank also raised rates by 0.5% as widely expected. They were optimistic that inflation is on the way down and may be falling quicker than previously thought. They did continue to stress that inflation is still well above target and the ECB said that interest rates are likely to rise further. Eurozone markets seem to be expecting almost 1% of further rate hikes over the course of this cycle.

This week, we will see the German CPI inflation data for January. The previous estimate showed a big monthly decline in overall inflation but no change in the core rate. A big drop in inflation in the German numbers would point to a similar picture for the Eurozone inflation due on 23rd February. The January Eurozone number fell to 8.5%. This is unlikely to affect the ECB’s March rate decision but may affect the path of rates from there. Eurozone retail sales are expected to be soft though GDP in the Eurozone last week unexpectedly rose by 0.1% in the fourth quarter.

EURUSD – 1.0740

EURGBP – 0.8917

The Federal Reserve also did what markets were expecting with a smaller 0.25% rate hike. The Fed did warn that further hikes are likely. The Fed’s press statement suggested that they needed to be vigilant with at least two further 0.25% hikes likely. This was brought into context with the very strong employment numbers on Friday. As is often the case following policy updates, a lot of speeches are scheduled including one from Fed Chair Powell, where he may well comment on the employment situation.

The more surprising news last week was the much stronger-than-expected employment report. The non-farm payrolls headline rose by 517,000 in January, with the unemployment rate falling to 3.4%. On the flip side, lower-than-expected wage rises suggest that inflationary pressures may be easing. The US dollar had been on the back foot since the start of the year, but there was a significant recovery helped by this jobs data and the expectations of further rate hikes.

This week, there is very little data to update the markets. We will see the international trade for December and the University of Michigan consumer sentiment survey. Sentiment may have fallen back slightly after two months of gains. The report will also give some insight into whether inflation expectations continue to fall. Finally, President Biden will give his annual State of the Union address. He may urge Congress to raise the federal debt ceiling, warning of the economic consequences if this is not done.

GBPUSD – 1.2044

EURUSD – 1.08740

Do get in touch if you would like to discuss this further.

*Interbank rates correct at 7 am on the date of publishing.