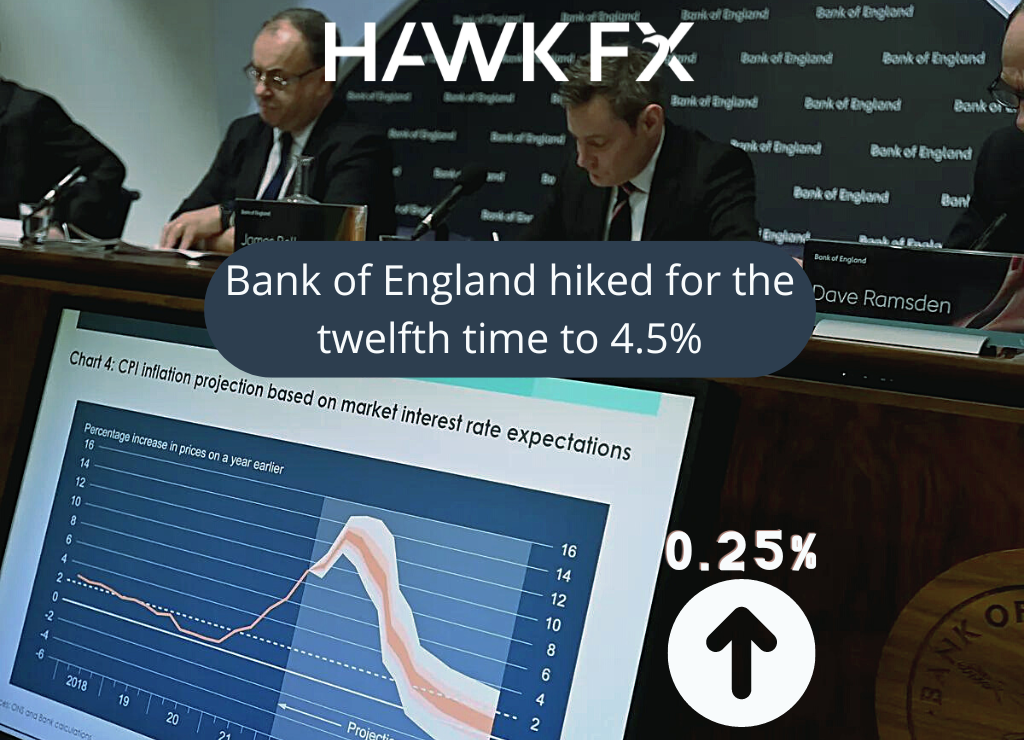

Last week, the Bank of England increased rates for the twelfth time in a row. As expected, they raised rates this time by 0.25% to 4.5%. The BoE persistently high inflation on higher food prices and called industry bosses in to discuss. In the end, the Bank’s forward guidance is similar to the previous update showing that they will hike again if inflation is more persistent.

The Bank also updated its economic forecasts, which upgraded growth forecasts seeing the UK avoid a recession with higher GDP forecasts for the next two years (0.1% for Q1). The unemployment rate is expected to rise by less than previously expected. Importantly, the BoE sees inflation risks skewed significantly to the upside, which has led markets to price in at least one further 0.25% hike in this cycle, and more likely two hikes.

This week, the labour market report will be closely watched. We expect employment growth to show an increase above 300k in the three months to March, with unemployment falling to 3.7% from 3.8%. Given how tight the market is, we expect wage growth to have increased again to 6% (excluding bonuses to 6.7%), which will keep pressure on the central bank’s policymakers. Consumer confidence will also be likely to show a further modest improvement.

GBPEUR – 1.1475

GBPUSD – 1.2470

It is a quieter week this week with the main focus being the German ZEW survey. This will provide the first indications of how activity is progressing in the Eurozone in May. We will also see the EU Commission economic forecasts, which may have been adjusted upwards. The second reading of GDP for the first quarter is expected to be revised slightly higher to 0.1%.

Markets are also closely watching the Turkish election results. This is seen as a pivotal election, with a NATO member at the junction of Europe and the Middle East. Long-serving President Recep Tayyip Erdoğan is in the lead in the first round of voting, but may end up short of the 50% required for an outright win. This would take it into a run-off election against Kılıçdaroğlu, who is fighting on a platform of a return to more democratic practices.

EURUSD – 1.0867

EURGBP – 0.8715

The news in the US banking sector has generally been a bit calmer over the last week. With no further surprises, the equity markets have rebounded somewhat, with bond yields also falling. Inflation fell again slightly in April to 4.9% which was lower than expectations. Despite the stronger labour market, expectations remain that the Fed will hold rates steady at its next meeting in June.

Going forward, all eyes will be on whether data is supportive of the Fed holding interest rates steady. This week, we have retail sales and industrial production figures that will give a good indication of activity in the second quarter. Of more interest to the markets is the situation with the debt ceiling. There are suggestions that talks may take place between President Biden and the Republican leader of the lower chamber. It remains to be seen whether we will get constructive movement or whether this will be taken to the brink, as in previous episodes. This is expected between the start of June and August.

GBPUSD – 1.2470

EURUSD – 1.0867

Do get in touch if you would like to discuss this further.

*Interbank rates are correct at 7am on the date of publishing.